Let It Ride

Cui Bono? ... part two

Just so you know.

.

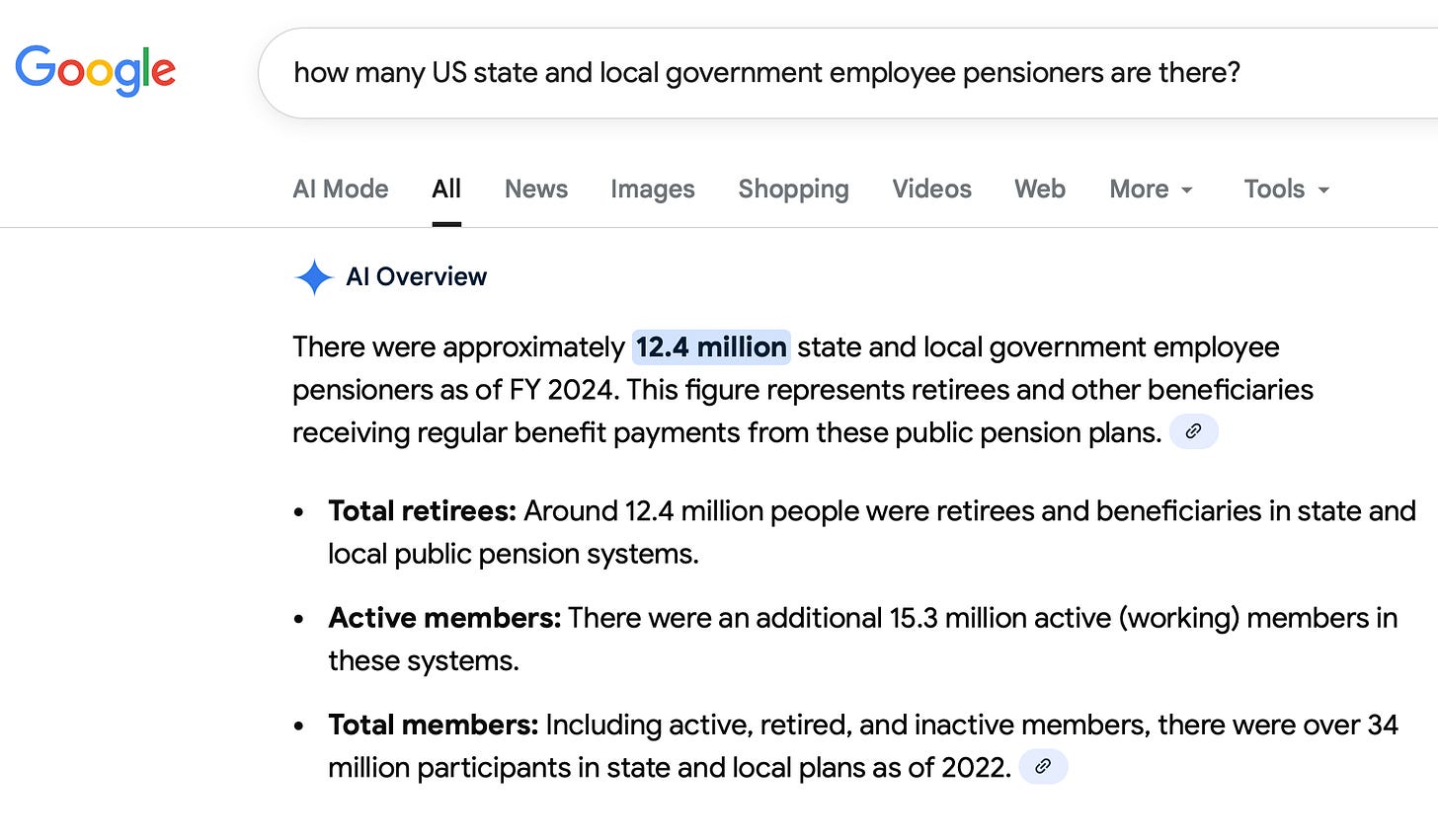

How many US state and local government employee pensioners are there?

12.4 million

.

.

What is the estimated yearly payment to a pension member from a US state or local employer?

$24,980

.

.

Let’s do the math.

12,400,000 X $24,980 =

$309,752,000,000

.

So, the pensioners in US state and local retirement systems currently represent a conservative financial obligation of over three hundred billion dollars annually. I say conservative about my calculation because a more official source, the US Census Bureau, has this to say:

“State and local government pension plans in 2024 provided $405.45 billion in benefit payments to beneficiaries (retirees as well as their spouses or dependent children), up 9.26% from $386.67 billion in 2023.”

That’s a lot of dough.

.

.

.

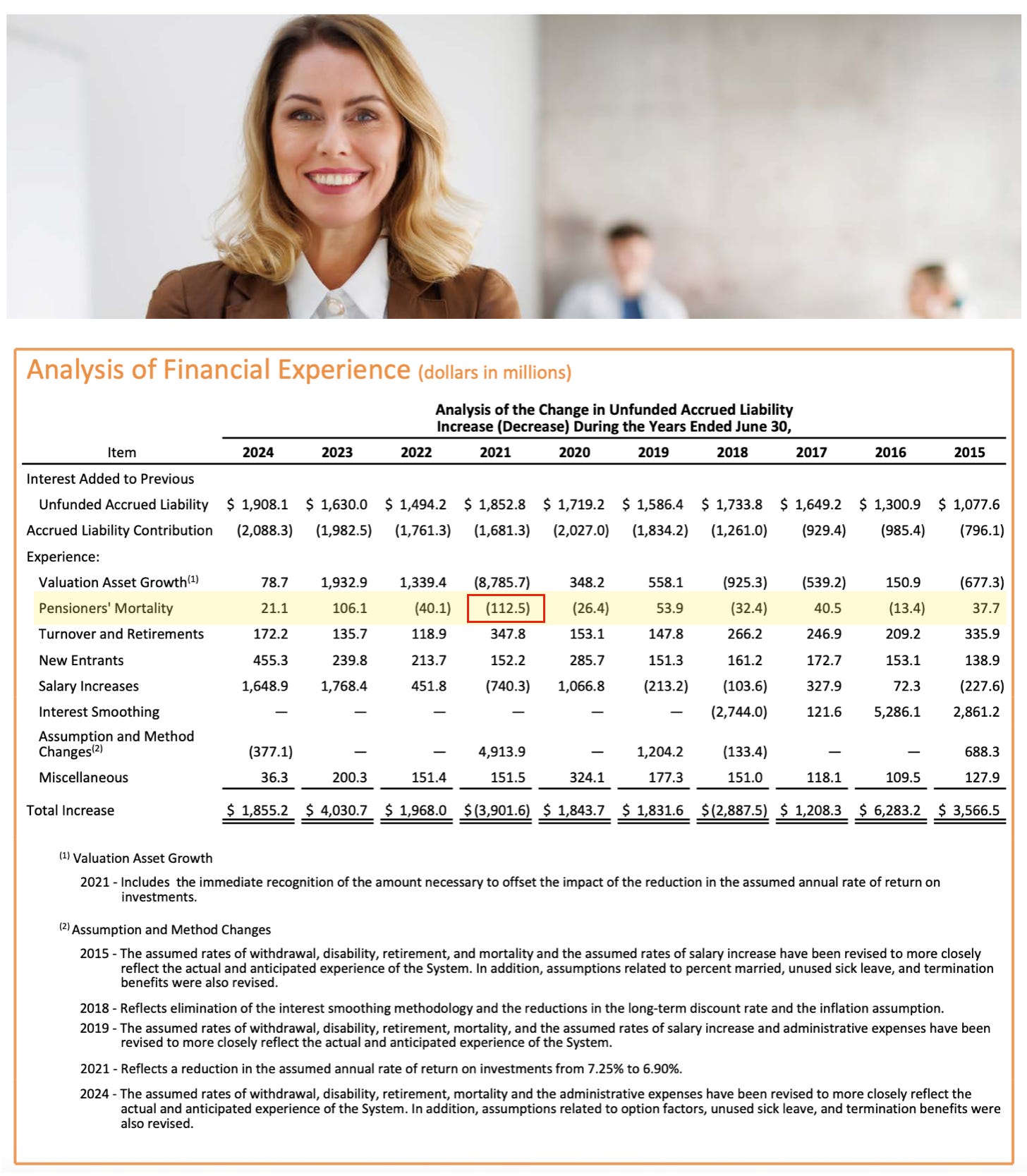

Now, even though I have already revisited the state of Georgia and its current state pension report for 2025 in recent days, I am going to call to your attention a fresh retirement document for just the teachers of Georgia. I was perusing this new report from them to just do my standard update on members removed and death benefits - (I will be doing that in the future.) But the archived pensioner mortality gain and loss table really got my attention. It is timely because it is extremely relevant to the topic of my last post … that is, the incredible turnaround in the financial gains/losses for all state and local systems between 2019 and 2021.

.

.

.

Teachers Retirement System of Georgia

Annual Comprehensive Financial Report

Fiscal Year Ended June 30, 2025

.

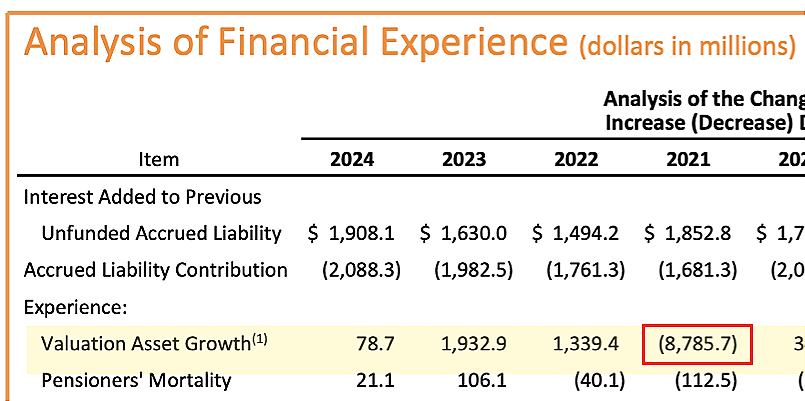

page 68 (Analysis of Financial Experience)

($ in Millions)

.

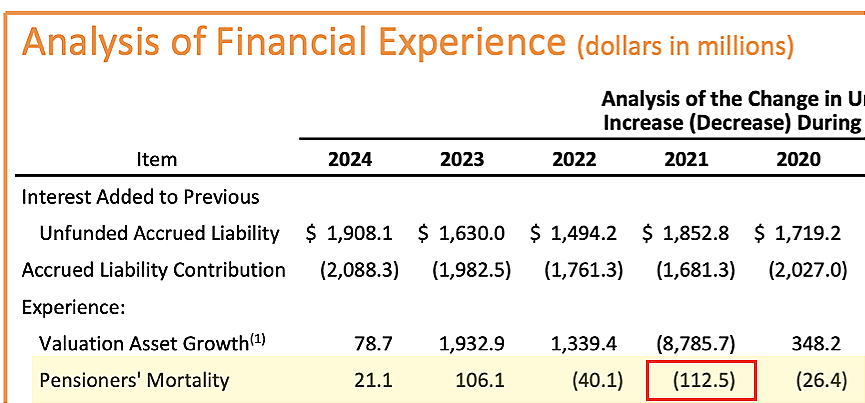

A closer look …

.

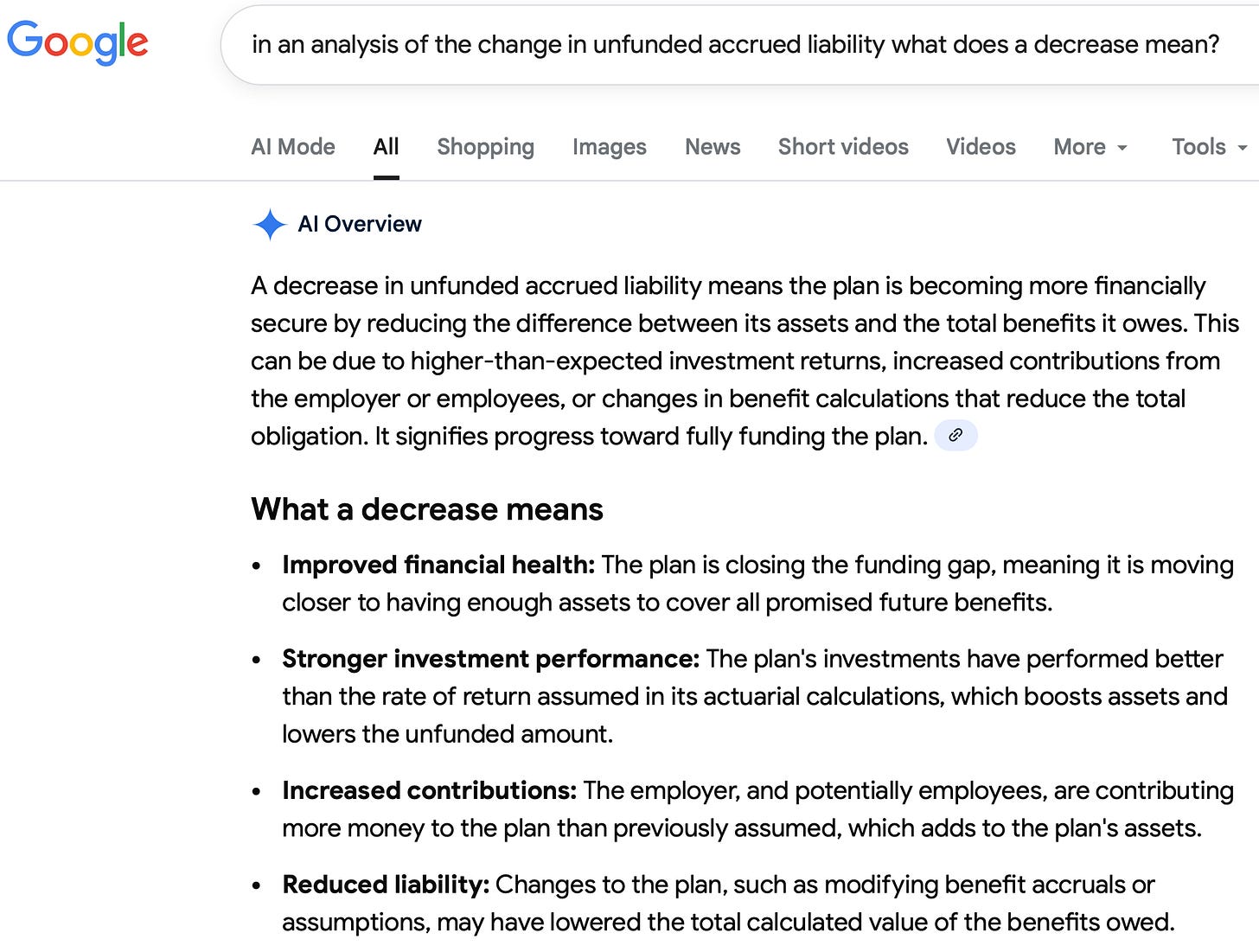

So in the previous post “Your Money … And Your Life / Cui Bono?” those actuarial gains and losses tables from Michigan had the gains without parentheses and losses with them. From experience, I know that you have to pay attention from one pension system to the next for just how they handle those parentheses. Here in this Georgia teachers report it is the opposite. In it the terminology is slightly different - instead of gains and losses, we have increase or decrease. If you can read the small type for the description at the top of this Georgia table, it reads:

“Analysis of the Change in Unfunded Accrued Liability Increase (Decrease) During the Years Ended June 30”.

Now that is potentially hard to wrap your head around, at least it was for me. So I asked for a little help:

In an analysis of the change in unfunded accrued liability what does a decrease mean?

“AI Overview

A decrease in unfunded accrued liability means the plan is becoming more financially secure by reducing the difference between its assets and the total benefits it owes. This can be due to higher-than-expected investment returns, increased contributions from the employer or employees, or changes in benefit calculations that reduce the total obligation. It signifies progress toward fully funding the plan.

What a decrease means

Improved financial health: The plan is closing the funding gap, meaning it is moving closer to having enough assets to cover all promised future benefits.

Stronger investment performance: The plan’s investments have performed better than the rate of return assumed in its actuarial calculations, which boosts assets and lowers the unfunded amount.

Increased contributions: The employer, and potentially employees, are contributing more money to the plan than previously assumed, which adds to the plan’s assets.

Reduced liability: Changes to the plan, such as modifying benefit accruals or assumptions, may have lowered the total calculated value of the benefits owed.”

.

.

… I guess Google AI never considered that a bunch of pensioners dying all at once might also be a reason for a drastic decrease in liability.

.

Okay, so I think we have established that the number on the table for “Pensioner’s Mortality” in fiscal year 2021 is a big gain back of funds for the teachers retirement system in Georgia. That number is in millions.

That is $112,500,000 that came back to the pension fund’s asset column due to pensioner’s mortality in 2021. (And if you throw in the numbers from 2020 and 2022, another $66,500,000 in assets got credited).

.

To recap: in just one US state’s teachers pension plan, over a hundred million dollars was gained in 2021 from its pensioners dying sooner than expected.

.

Sure, you can look at other years on that table and point out that previous and later years saw increases in that same liability.

That is true.

2023 saw this mortality liability go up over 100 million. Not sure why that happened, but we have to point that out if we are being fair.

.

But there is more …

.

Another detail worth mentioning is a peculiar similarity that this table has with the 2021 gain/loss from Michigan. Recall that 2021 saw not only big numbers for mortality there, but also a very big number for “Investment Income”:

.

That is a nice 1.3 billion asset for the Michiganders.

.

Now on this table for the Georgia teachers, please look at the number right above our pensioner’s mortality figure for 2021. That figure is for the system’s “Valuation Asset Growth”. It is a very large number:

.

Again, we are talking billions on that … multiply 8,785.7 by a million.

.

$8,785,700,000 in 2021 alone was put into the Georgia teachers assets.

.

8.7 billion dollars.

.

.

.

What the hell is that all about?

.

Is that a bribe … a payoff?

.

Something stinks.

.

.

.

The Pew Research folks can simply chalk these awesome assets being warp sped back into the local pension coffers as just good gambling bets paying off in the big casino, but I don’t think I buy it.

It is my belief that the perpetrators of this horror are surely at the helm of the money machines and can spew out those tokens at their whim. It would be nothing for them to orchestrate a miraculous economic recovery in the middle of a pandemic of their own making and compensate the middle managers for a job well done.

.

That’s my two cents.

.

.

.

*in case you have forgotten …

Pandemic Milestones:

January 20, 2020

-First covid case in the U.S.

December 11, 2020

-Pfizer Emergency Use Authorization

December 18, 2020

-Moderna Emergency Use Authorization

August 23, 2021

-Pfizer full FDA approval

December 2021 / January 2022

-CDC and FDA revise booster recommendations

-Rapid booster uptake

January 31, 2022

-Moderna full FDA approval

August 31, 2022

-FDA authorized Pfizer and Moderna’s new bivalent COVID booster vaccines

April 10, 2023

-Biden declares the end of the pandemic

.

.

.

Those numbers -- hundreds of millions and billions -- are staggering. They really clarify that what happened was no accident. Great work, albeit infuriating (through no fault of yours, you’re the messenger).

The idea of killing off lots of pensioners (to avoid paying out the pensions and to avoid paying out on expensive elderly healthcare) is just too EVIL for most people to contemplate. Yet it was a main objective of the Covid criminals. Pre-meditated mass murder via bioweapons and via the not-a-vaccines are the bankers’ new methods … the same London, Swiss, and Wall Street bankers who literally made a killing from WW1 & WW2. And I do agree with commenter, David Shohl, it is infuriating to see actual numbers!